From Backup and Recovery to Data Protection Platforms

Gartner’s 2025 Magic Quadrant marks a significant evolution in how the enterprise backup market is defined. What was previously the “Enterprise Backup and Recovery Software Solutions” MQ has been rebranded and re-scoped as “Backup and Data Protection Platforms”. This renaming isn’t just semantic – it reflects new demands on backup vendors to provide broader data protection capabilities beyond traditional backup and restore. In Gartner’s view, today’s enterprise backup platforms must function as holistic data protection hubs, spanning on-premises, hybrid cloud, and SaaS environments. The 2025 MQ’s market definition and criteria have been updated accordingly, emphasizing features like centralized management, Backup-as-a-Service delivery, cyber-resilience, and even leveraging backup data for analytics and AI.

Several factors drove Gartner to redefine the quadrant. Enterprises now face sprawling, complex data estates spread across multicloud and SaaS applications, all of which need protection. This has pushed backup vendors to expand their scope: offering hybrid-cloud support, more autonomous or orchestrated operations, and capabilities that add value beyond recovery (e.g. sensitive data discovery, classification, or using backup data for business intelligence). Notably, Gartner explicitly calls out emerging features like retrieval-augmented generation (RAG) – a nod to GenAI – where backup platforms enable AI models to tap into backed-up data. The inclusion of such criteria shows Gartner’s prioritization of GenAI and AI-driven insights in data protection, alongside staples like ransomware anomaly detection and recovery automation. In short, the new quadrant sets a higher bar: vendors must deliver a “data protection platform,” not just backup software, blending backup/recovery with cyber security, cloud mobility, and even AI capabilities.

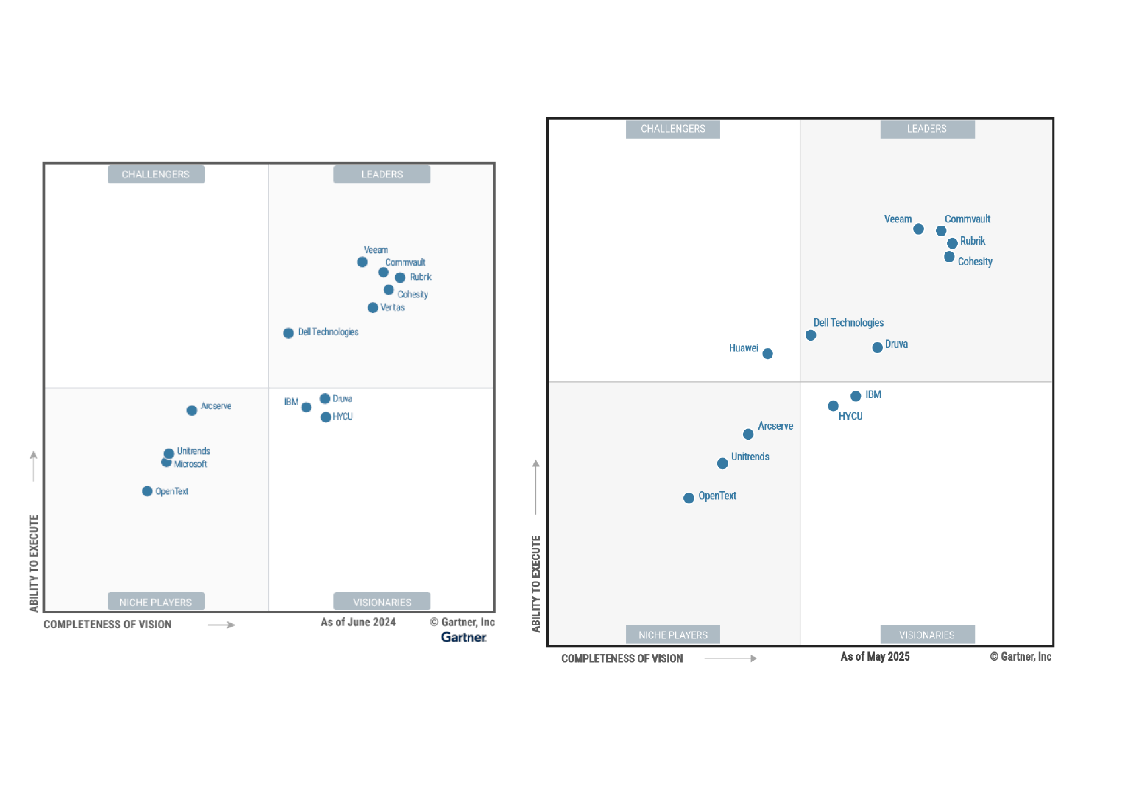

Leaders Quadrant: Who’s Up, Who’s Out

The Leaders quadrant in 2025 features some familiar faces and one big newcomer. Veeam, Commvault, Dell Technologies, Rubrik, and Cohesity all retain Leader status from last year, joined by Druva, which makes a big leap from Visionary to Leader. Meanwhile, one long-time Leader is conspicuously absent: Veritas. Gartner removed Veritas entirely from the 2025 MQ after Cohesity completed a December 2024 transaction to merge with Veritas’s enterprise data protection business. As a result, Veritas’s flagship NetBackup and Alta products now fall under Cohesity’s umbrella, instantly enlarging Cohesity’s portfolio and customer base. Gartner notes that Cohesity “now includes the NetBackup and Alta Data Protection” line, giving it broader expertise and global reach. This consolidation solidified Cohesity’s Leader position, though Gartner does caution that overlapping products post-merger could pose integration challenges. Still, the Cohesity-Veritas combo represents a major market shake-up – two Leaders becoming one – and symbolizes the ongoing consolidation trend in the industry.

Druva’s promotion to Leader is another notable shift. In 2024, Druva was pegged as a Visionary with strong cloud backup technology but still maturing execution. Over the past year, Druva appears to have closed that gap. Its fully SaaS-based Data Resiliency Cloud gained enhancements like cross-cloud backup support (e.g. Azure Storage as a target for AWS/Azure VMs) and deeper integration with Microsoft’s security ecosystem (Sentinel SIEM and even Microsoft’s Security Copilot AI). Druva also rolled out an AI-powered admin assistant (“Dru Investigate”) and a free 24/7 managed ransomware defense service. These moves bolster both its vision and execution, explaining why Gartner now places Druva among the Leaders. For enterprise buyers, Druva’s rise validates the cloud-native BaaS model as truly enterprise-ready – a fully managed backup platform can now compete head-to-head with the established on-prem vendors on features and reliability.

The rest of the Leaders have largely held their ground, but with ongoing advancements. Veeam is once again named a Leader, marking its ninth consecutive Leader placement. Gartner emphasizes Veeam’s strong market presence and partner ecosystem. Over the last year Veeam focused on shoring up ransomware resiliency – adding AI-based malware scanning, “Threat Hunter” tools, and even introducing a ransomware recovery warranty program (Veeam Cyber Secure) that provides incident response support during breaches. Veeam’s feature updates (v12.3 of its platform) also added support for things like Microsoft Entra ID (Azure AD) protection and AI-driven insights via a new “Veeam Intelligence” engine. Gartner does chide Veeam for a “reactive approach” to innovation (often responding to competitors rather than leading) and notes Veeam still has some SaaS protection gaps beyond M365. Nonetheless, Veeam’s consistent execution and breadth – covering enterprises down to SMBs – keep it firmly in the Leader pack.

Commvault likewise remains a Leader, continuing its reinvention from a legacy backup vendor into a cyber-resilient data management platform. Gartner highlights Commvault’s broad workload coverage (including databases, cloud VMs, SaaS apps) and its “Cloud” portfolio approach that now spans data protection, risk analysis, and cyber recovery. In the past year Commvault made two strategic acquisitions – Appranix (April 2024) for cloud app disaster recovery orchestration, and Clumio (Oct 2024) for bolstering its SaaS/cloud backup capabilities. These buys expand Commvault’s cloud-native prowess, giving it features like complete application stack protection and deeper AWS support. Commvault’s challenge has been modernizing its user experience (they’re still unifying old interfaces), but the MQ placement indicates it’s executing well overall. For buyers, Commvault’s continued leadership means its strategy of blending traditional enterprise backup with new cloud and security features is paying off – and those invested in its ecosystem (including Metallic SaaS) are seeing innovation momentum.

Rubrik is also designated a Leader again, noted for its focus on data security integration. Rubrik spent the year deepening its cyber features and multicloud coverage. It added protection for key SaaS and cloud-native sources (Salesforce, Dynamics 365, Azure DevOps, GitHub, Oracle Cloud VMs/databases), and introduced new threat detection capabilities for cloud workloads. A standout was Rubrik’s emphasis on Cyber Recovery: the company introduced “Turbo” threat hunting (leveraging Mandiant threat intel) and prioritized restore for Microsoft 365 to help recover quickly from ransomware. Rubrik even ventured into GenAI territory with an initiative dubbed “Annapurna” for GenAI application development. And just days before the MQ release, Rubrik announced it is acquiring Predibase, an AI startup, to accelerate “agentic AI” capabilities on its platform. This bold bet aims to turn backed-up data into a training ground for enterprise AI models, positioning Rubrik at the intersection of data management and AI. The MQ placement affirms Rubrik’s strong execution, but enterprise buyers should watch how these ambitious AI plans translate into usable features. It’s a reminder that backup data is increasingly seen as a valuable corpus for analytics and AI – a trend Gartner clearly encourages.

Dell Technologies rounds out the Leaders, continuing to leverage its extensive portfolio (PowerProtect, Avamar, NetWorker, Cyber Recovery vaults, etc.) and huge install base. Gartner kept Dell in the Leader quadrant, citing the breadth of its offerings and integrations (e.g. tight links between Dell storage and its data protection software). Dell introduced features like Advanced Kubernetes protection and even mainframe data integration in the prior year’s MQ, and it offers a mix of software, appliances, and cloud services (APEX Backup-as-a-Service). One observation from 2024: Dell had been slightly behind the top pack in “vision”. In 2025, Dell appears to have maintained a solid if not flashy trajectory – it didn’t have headline-grabbing acquisitions or cloud-native pivots, but it reliably delivered incremental improvements (for example, better SaaS app backup via OEM partnerships and expanding its cyber vault automation). For conservative large enterprises with heavy on-premises footprint, Dell remains a safe, “full-stack” Leader. But buyers should ensure Dell’s roadmap aligns with emerging needs like broader SaaS coverage and more cloud-agnostic capabilities, areas where pure-play competitors are pushing fast.

Visionaries and Niche Players: The Rest of the Pack

Outside the top-right Leader quadrant, Gartner’s 2025 MQ positions a mix of emerging innovators and smaller legacy players. The Visionaries quadrant this year features HYCU and IBM (as in 2024), both aiming to push new ideas in data protection but lacking some element of execution or scale to be Leaders. HYCU is again a Visionary, differentiated by its SaaS-centric, API-driven approach to multicloud backup. HYCU’s R-Cloud platform has a unique strategy for SaaS app coverage using an AI-assisted, low-code integration model – enabling support for a long tail of SaaS apps beyond just M365 or Salesforce. Over the last year, HYCU expanded its ransomware protection (launching R-Shield for VM snapshot scanning) and even built integrations to work with Dell’s PowerProtect appliances. Its strengths lie in comprehensive SaaS protection and strong support for Google Cloud (GCP) environments. However, Gartner notes HYCU still primarily serves mid-market customers and has limited presence in large enterprises. Its ransomware defenses also lag behind leaders – anomaly detection is limited to Nutanix VM backups, for example. For organizations that heavily leverage cloud-native and SaaS and want a nimble solution, HYCU is a Visionary to watch. But enterprises should weigh HYCU’s smaller size and current feature gaps in cyber-resilience before heavily betting on it for mission-critical needs.

IBM remains in the Visionaries quadrant, reflecting its ongoing reinvention of its aging Tivoli/TSM lineage into the modern “IBM Storage Defender” suite. IBM has folded its Spectrum Protect products into a new cloud-friendly portfolio (Storage Defender Data Protect and related offerings). The strategy is to integrate backup with broader data management and security – IBM touts cyber-resiliency and data copy management as key differentiators. In the past year, IBM’s execution has improved only modestly; Gartner kept it as a Visionary due to IBM’s strong long-term vision (especially for large enterprise use cases and integration with IBM’s storage and mainframe world) but relatively limited market momentum. Notably, IBM did not crack the Leader circle, indicating it still trails the pure-plays in market perception and cloud-era agility. Gartner’s 2024 analysis pointed out IBM had slipped in vision completeness compared to prior years – by 2025 it appears IBM stabilized but did not surge ahead. Enterprise IBM shops should track how Storage Defender develops, especially any AI-driven capabilities IBM might bring (given IBM’s investments in AI elsewhere). But unless IBM can show real innovation beyond its installed base (and better multi-cloud support), its Visionary status may not translate to leadership in market share.

The Challengers quadrant – high execution but limited vision – is surprisingly sparse again in 2025. In fact, the only named Challenger is a new entrant: Huawei. Huawei’s inclusion in this MQ is new; last year Gartner excluded Huawei because its product wasn’t globally generally available in time. Now, Huawei’s OceanProtect backup software and appliances qualified, and Gartner placed the company as a Challenger, acknowledging Huawei’s strong execution (likely in APAC markets) but narrower vision and global reach. Huawei offers a mix of software, hardware and BaaS, and its solutions are known to be cost-competitive and high-performance for backup of large datasets. However, outside of China and certain regions, Huawei has limited penetration, and political considerations can hinder its expansion. For global enterprises, Huawei’s appearance as a Challenger might be more relevant to those operating in regions where Huawei is prevalent. No other Challengers are listed; tellingly, Arcserve, which Gartner had once positioned as a Challenger in 2023, was downgraded to Niche in 2024 and remains Niche in 2025. This indicates that the biggest players have both the execution and vision, leaving few pure “high execution, low vision” vendors left – you either bring the full package or you get categorized below.

The Niche Players quadrant in 2025 consists of vendors focused on specific segments (often mid-market or legacy environments) and not leading in either vision or execution for large enterprises. Arcserve, OpenText, and Unitrends (Kaseya) fall in this category (as they did previously), and notably Microsoft would have been here too – except Microsoft was dropped from the MQ entirely this year. Gartner eliminated Microsoft’s Azure Backup from consideration because it failed to meet mandatory feature criteria – specifically, it lacks multi-cloud backup support. In 2024, Microsoft had been rated a Niche Player, with Gartner critiquing its fragmented backup tools and lack of cross-cloud capabilities. Rather than improve dramatically, Microsoft chose not to participate in MQ research and remained Azure-centric, so Gartner cut it. This is a stark example of the new bar set by “Data Protection Platforms” – even a giant like Microsoft was deemed too limited (protecting only its own cloud) to be included. Enterprise customers using Azure Backup or DPM should take note: Gartner essentially suggests those are point solutions, not full-fledged enterprise backup platforms.

Among the remaining Niche players, Arcserve continues to target midmarket and lower enterprise with its UDP software, appliances, and cloud services. Gartner acknowledges Arcserve’s renewed product investment (e.g. launching UDP 10 with features like immutable storage and disaster recovery testing). Arcserve also offers flexible pricing (per TB, per socket, etc.) which can be attractive to cost-sensitive buyers. However, Arcserve’s focus on midsize customers means it struggles to scale up – Gartner cautions its roadmap and support may “limit its suitability for large enterprises”. Arcserve also lags in incorporating AI/ML, lacking any GenAI or advanced anomaly detection in its features. Thus, while solid for straightforward backup needs (especially with a mix of software-appliance and SaaS backup via its Keepit OEM partnership), Arcserve remains a step behind the visionary curve.

OpenText (which inherited the old HP/Micro Focus Data Protector product) also stays a Niche Player. OpenText’s strengths lie in its tight integration within its own software ecosystem – for example, using its Webroot acquisition for built-in malware scanning of backups, and tying into Documentum content management for specialized data protection. It supports a wide array of hypervisors and workloads, from VMware to OpenStack and even Huawei Cloud, reflecting its legacy in heterogeneous environments. Yet OpenText has been slow to innovate beyond its base. Gartner notes the lack of a true SaaS control plane or a vendor-hosted BaaS option for OpenText’s backup – meaning customers still mostly deploy and manage the software themselves. OpenText’s development focus has been on integrating Data Protector with the rest of OpenText’s portfolio, possibly at the expense of broader market “table stakes” like AI, broad SaaS app coverage, or a modern user experience. For enterprises running Data Protector due to longstanding investments, OpenText provides continuity, but they risk missing out on newer capabilities. Buyers should press OpenText on its roadmap for things like a cloud-based management, as the lack of these features is cited by Gartner as a competitive shortfall.

Finally, Unitrends (part of Kaseya) continues as a Niche Player, catering mainly to MSPs and SMBs with its appliance-based backup and Spanning 365 backup product. Gartner points out that Kaseya is in the process of consolidating Unitrends with the Datto Backup business (also owned by Kaseya) to enrich its offerings. This kind of internal consolidation could improve Unitrends’ portfolio (Datto had strong MSP-focused cloud backup capabilities), but it’s also a sign that Unitrends alone wasn’t keeping pace. Strengths for Unitrends include cost-effective cloud storage (they offer egress-free cloud retention) and integration with Kaseya’s IT management tools, which is convenient for MSPs. However, Gartner calls out Unitrends for limited scalability and enterprise suitability – its appliances don’t scale well for very large environments – and a stagnant SaaS backup scope (no new SaaS apps added, still largely just M365). It also notably has no GenAI or AI-driven features on its roadmap. For organizations in the midmarket or those using Kaseya’s IT management stack, Unitrends can be a cost-efficient option. But the lack of enterprise references and slower pace of innovation mean Unitrends will likely remain niche unless the Datto merger significantly transforms its tech stack.

What’s Changed: Gartner’s New Criteria and Priorities

Comparing the 2025 “Backup and Data Protection Platforms” MQ to the 2024 backup MQ reveals how Gartner’s evaluation criteria have shifted to mirror the changing landscape. One clear change was stricter inclusion criteria: vendors had to meet all “mandatory” features in the new market definition. The dropping of Microsoft underscores this – multi-cloud capability (protecting more than one cloud platform) was evidently a required criterion, which Azure’s native tools did not satisfy. Acronis had already been dropped in the 2024 cycle for a similar reason (focus on endpoints/MSPs and not meeting enterprise inclusion criteria). In 2025, Gartner is essentially saying that a viable data protection platform must cover hybrid and multicloud environments, not just a single-vendor ecosystem. This raises the bar especially for cloud-provider solutions or smaller specialists. Enterprise buyers should therefore look for vendors that support all the environments they have today and plan to have tomorrow – including multiple public clouds and a variety of SaaS applications.

Another emphasis in 2025’s criteria is on cybersecurity and ransomware resilience as first-class capabilities. Gartner has been pushing this for a few years, but the new MQ description highlights things like immutable storage, anomaly detection, malware scanning, and incident response orchestration as key differentiators. Many of the Leaders gained or maintained their positions by investing heavily in these areas (e.g. Veeam’s in-line malware scanning and ransomware warranty, Rubrik’s threat hunting and isolated recovery features, Cohesity adding post-quantum encryption and threat analytics via its acquired portfolio, etc.). Simply put, backup is no longer just about recovering from accidental deletions or outages – it’s about being the last line of defense against cyber-attacks. Gartner is rewarding vendors who bake in zero-trust principles (just-in-time access, 2FA, tamper-proof backups) and those who offer rapid recovery from ransomware events. Enterprise IT buyers should scrutinize how each vendor addresses ransomware: Do they offer early detection? Can they automate recovery steps? Do they have an isolated vault or guaranteed clean copies? Given the rise of attacks, these features are crucial – and in Gartner’s eyes, they separate Leaders from laggards.

The new MQ also reflects Gartner’s interest in how backup data can be “augmented” for more than backups. The market overview explicitly calls out expanding use cases for backup data such as compliance, analytics, and AI/ML training. Gartner expects modern data protection platforms to provide value from dormant backup data – whether via built-in data classification and search, or exposing APIs to feed data to analytics tools and AI models. For instance, Gartner mentions capabilities like sensitive data scanning and retrieval-augmented generation (RAG) using the backup data. This has influenced vendors to introduce features like Microsoft 365 data classifiers (e.g. Commvault integrating data discovery tools) or partnerships to use backup data in SIEMs and AI ops (e.g. Druva’s integration with Sentinel and Copilot). Even the Rubrik-Predibase acquisition is a sign of this trend – turning backup repositories into AI-ready data lakes. While these capabilities are nascent, enterprise buyers should think ahead: a backup platform that can double as a data intelligence platform might unlock extra ROI. At minimum, look for vendors that enable easy search and eDiscovery across backups, as well as those talking about data reuse (for dev/test, analytics, etc.) – Gartner is clearly valuing this in its vision criteria.

Additionally, the 2025 MQ heavily favors vendors with robust Backup as a Service (BaaS) offerings or at least a mix of deployment models. As per Gartner’s earlier projections, by 2028 the majority of enterprises will be using BaaS alongside on-prem tools. In line with that, Gartner’s criteria put weight on having a vendor-hosted SaaS option and a unified management experience across on-prem and cloud. We see this in cautions for vendors like OpenText, which lacks a SaaS control plane, and praise for those like Druva that are cloud-native by design. Multi-tenancy, global management and on-demand scaling – all inherent to BaaS – are increasingly seen as must-haves. Even traditionally on-prem vendors have responded: Commvault’s Metallic, Dell’s APEX, Cohesity’s expanding SaaS portfolio, etc., are all attempts to check the BaaS box. Enterprises should consider their appetite for cloud-based backup vs. self-managed, but note that Gartner is nudging the market toward as-a-service consumption. The MQ suggests that even if you still deploy software on-prem, the vendor should offer a SaaS-like experience (e.g. cloud-based management interfaces, subscription pricing, etc.). SaaS-era usability is the new bar – clunky legacy consoles and purely CapEx licensing are increasingly signs of a Niche player.

Finally, it’s worth noting Gartner’s methodology itself: the Magic Quadrant, while influential, has its biases and blind spots. It tends to reward broad feature lists and market presence, which can disadvantage specialized or younger companies that might excel in one area (for example, a best-of-breed M365 backup provider isn’t here because they don’t do databases or VMs). Gartner also requires vendor participation and reference customers. We saw that vendors who didn’t fully engage or meet timing (like Microsoft, and earlier Huawei) can get excluded. This means the MQ is not an absolute ranking of technical merit, but rather a reflection of which vendors tick Gartner’s boxes at a given time. For instance, a company focusing on one cloud platform or one segment may be very innovative, but they won’t appear unless they broaden out. Enterprise IT teams should thus use the MQ as a starting point, not a final answer – it identifies the big, comprehensive players and how they stack up on vision vs execution, but you’ll need to drill into Critical Capabilities reports and do your own proof-of-concepts to see which solution truly fits your needs. Also, consider the impact of consolidation: when Leaders merge (as with Cohesity-Veritas), Gartner quickly adjusts their position, but the real-world integration and support experience might lag. Being a Leader in the quadrant doesn’t magically resolve product overlaps or cultural integration issues. A critical eye is needed when a vendor’s MQ position jumps due to M&A – validate that the combined offering is actually delivering value, not just promising it.

Strategic Recommendations for Buyers

In light of the 2025 MQ and overall market trends, here are some strategic considerations for enterprise backup and data protection buyers:

- Map Vendor Strengths to Your Priorities: Use the MQ as a map of who excels where. Leaders like Veeam and Commvault offer broad, well-rounded solutions – good if you need all the boxes checked – whereas Visionaries like Druva or HYCU might outshine others in cloud/SaaS protection or innovative features (but could lack on-prem legacy support or scale). If your organization is cloud-first with lots of SaaS, a newly crowned Leader like Druva or a Visionary like HYCU could serve you better than a legacy-leaning Leader. Conversely, if you have a complex on-prem environment or specific apps (Oracle, mainframe, etc.), vendors like Dell or Commvault that cover a wide spectrum might be safer. Align the vendor’s focus with your business needs.

- Demand Cyber-Resilience Features: Ransomware is the elephant in the room. Ensure any solution on your shortlist has robust ransomware defense and recovery capabilities out of the box. This includes support for immutable backups, malware scanning, anomaly detection, and automated recovery playbooks. Some vendors now even offer guarantees/warranties or dedicated incident support (e.g. Veeam’s ransomware recovery warranty). While these programs vary, they indicate a vendor that takes cyber threats seriously. Don’t hesitate to ask for demos of how a backup product detects and handles a ransomware event. The MQ Leaders generally excel here, but even among them, approaches differ – evaluate whose strategy (isolated vaults vs. deeply integrated threat intelligence vs. insurance-like warranties) fits your risk posture. Remember Gartner’s prediction: by 2028, 90% of backup solutions will embed cyber-threat detection, up from <45% in 2024. You should be investing in a platform that is already on that trajectory.

- Consider Cross-Cloud and SaaS Coverage a Mandate: If a vendor cannot protect data across all major clouds (AWS, Azure, GCP at least) and a broad set of SaaS apps, think twice. Even if you’re a single-cloud shop today, multi-cloud is increasingly common (often via M&A or shadow IT), and Gartner clearly made multi-cloud support a mandatory criterion. The same goes for SaaS – Microsoft 365 is table stakes, but look for support for other critical SaaS like Salesforce, Google Workspace, ServiceNow, etc., or a roadmap to add them. Gartner foresees 75% of enterprises prioritizing SaaS backup by 2028 (up from just 15% in 2024), so this area can’t be ignored. If a vendor is weak on SaaS, you may end up managing multiple point solutions which increases risk and overhead. Prioritize vendors that offer a one-stop platform for diverse workloads, or at least provide easy extensibility (for example, via APIs or third-party integrations) to cover new SaaS as they arise.

- Evaluate Platform Versatility and Data Reuse: Modern data protection is about more than restore. Ask how vendors enable you to leverage your backup data for secondary use cases – be it analytics, compliance, or feeding an AI model. Some platforms have built-in eDiscovery, data classification, or even the ability to run VMs directly from backups for testing. Gartner specifically suggests investing in solutions that “offer added use cases for backup data” like sensitive data scanning, BI/reporting, and API-based data access for apps. For example, Commvault and Rubrik both pitch the idea of using backups as a data lake for analytics or security insights. While not every organization is ready to plug their backup into an AI pipeline, choosing a platform with these capabilities could pay dividends down the road. At minimum, capabilities like global full-text search across backups, or integration with compliance tools, can turn your backup repository into a value-generating asset rather than an isolated insurance policy.

- Weigh Costs and Consumption Models Carefully: Pricing and licensing in this space can be complex – capacity-based, per-workload, appliance-based, SaaS subscription, etc. Gartner advises I&O leaders to weigh long-term cost implications of various models (front-end TB, back-end TB, VM-based, socket-based, etc.) and choose based on your environment’s growth patterns. For instance, front-end (source) terabyte licensing might be predictable if your data sources are growing steadily, whereas pure consumption (back-end) might surprise you if retention expands. Some vendors offer multiple models – Arcserve, for one, gives a choice of perpetual vs subscription and various metrics. Also consider operational costs: a cheaper software that requires heavy admin effort might cost more in the long run than a pricier, more automated SaaS service. As the MQ indicates, more enterprises are embracing BaaS, which often shifts costs to opex and can simplify scalability. Evaluate not just the license cost, but the total cost of ownership including infrastructure (do you need to buy and maintain storage/appliances?), manpower, and potential cloud egress fees for cloud backups. Engage vendors in discussions about flexible pricing – competition and consolidation are pressuring them to be creative to win deals.

- Plan for Vendor Viability and Roadmap Alignment: The backup market is consolidating – we’ve seen major moves like Veritas merging into Cohesity, and even speculation that others could combine. Smaller players might get acquired or struggle to keep up with the investment needed for AI and cloud features. So, when selecting a solution, consider the vendor’s long-term viability and ecosystem. Leaders like Dell and Commvault are diversified and stable but could be slower to innovate; up-and-comers like HYCU might innovate faster but could also become acquisition targets. Look at each vendor’s roadmap (Gartner’s MQ reports often hint at where each is heading) and ensure it aligns with your strategy. For example, if containerized workloads and DevOps integration are on your horizon, does the vendor support Kubernetes protection and API-driven operations? If AI-driven automation is a priority, what is the vendor doing with machine learning or GenAI in their platform? Given Gartner’s stance that by 2028, 75% of backup vendors will integrate GenAI for management, it’s worth asking how the vendor plans to use AI to improve usability and support. And importantly, have an exit strategy – whichever platform you choose, make sure you can get your data out if needed (through standard backup formats or cloud exports). The MQ Leaders generally are safe bets, but even big names can falter or pivot; a bit of due diligence on data portability and vendor health is insurance for your insurance.

Conclusion: A New Era of Data Protection Platforms

The 2025 Gartner Magic Quadrant portrays an industry at an inflection point. Backup is no longer a straightforward, musty segment of IT – it’s now a dynamic, innovation-fueled market converging with cloud management, security, and even AI. Gartner’s rebranded “Backup and Data Protection Platforms” MQ essentially challenges vendors to deliver all-in-one, versatile platforms that can protect anything, run anywhere, and do more with the data they store. The quadrant’s top-right is occupied by vendors who have embraced this philosophy: whether via acquisitions (Commvault, Cohesity), cloud-native architectures (Druva), deep security integration (Rubrik, Veeam), or sheer breadth (Dell). Meanwhile, legacy point solutions and laggards are being filtered out or pushed to the margins.

For enterprise buyers, the landscape offers more choice in some ways – you can go with ultra-modern SaaS or feature-rich traditional software or something in between – but also a caution: ensure your choice keeps pace with the rapidly evolving threat and IT environment. Ransomware, cloud sprawl, and regulatory demands are raising the stakes, and a backup platform must rise to the occasion as a “data protection platform.” Gartner’s MQ is one lens on who’s leading that charge, but your own business context is king. Take the MQ’s insights – the vendor moves, the criteria changes, the market trends – and apply them to your strategy. This year’s Magic Quadrant highlights a market consolidating around a few big players who can do it all, even as those players themselves transform (or combine). It’s an exciting, if challenging, time for those of us charged with safeguarding data. The old backup mantra of “trust but verify” now extends to vendors and features: trust the proven leaders, but verify that their solutions truly meet your needs for resilience, agility, and value extraction from data. In the end, the best backup solution for 2025 and beyond will be the one that not only helps you sleep at night (knowing your data is safe), but also one that can wake up and do more when morning comes – whether that’s feeding an AI model, instantly spinning up a dev environment, or thwarting the next cyber attack. The Magic Quadrant gives us a map of who might deliver on that promise; now it’s up to enterprises to navigate wisely.

Sources: Gartner Magic Quadrant for Enterprise Backup/Recovery (2025); Gartner Magic Quadrant for Backup and Data Protection Platforms (2024).